XM is an investment firm founded by financial professionals and headquartered in London, UK. XM's ambition is to provide fair trading for investors and traders, even with no negative balance with leveraged trading. XM offers almost all forms of financial trading, but with a wide range of currency pairs that can also be traded in the micro lot range, XM is also particularly interesting for beginners who want to test their forex trading skills initially with a small deposit. The minimum deposit for XM is $5. Regular promotions increase the attractiveness of XM.

XM Regulation

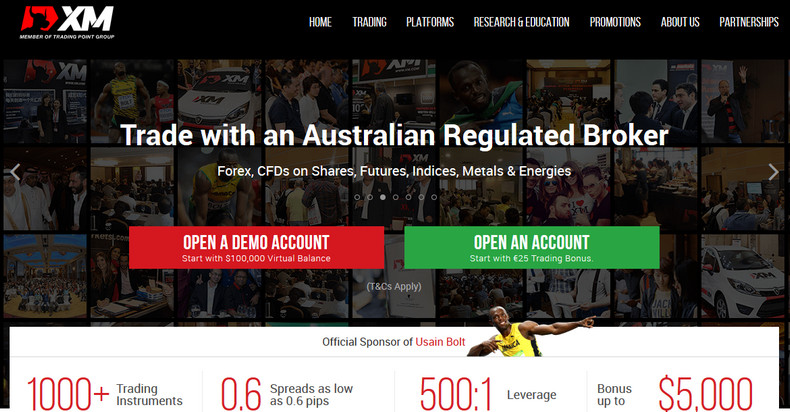

XM is a company of Trading Point of Financial Instruments UK Ltd, headquartered in London, where XM is regulated and supervised by FCA under reference number 705428. Another subsidiary within the European Union operates in Cyprus under the name Trading Point of Financial Instruments Ltd and is regulated there by CySEC according to EU law under license number 120/10. Customers outside the EU are served by the Broker through its subsidiary Trading Point of Financial Instruments Pty Ltd in Australia, regulated by ASIC under licence number 443670. Customers of the Australian subsidiary can benefit from a higher leverage in their trading than customers within the EU.

XM Instruments and Trading Environment

XM offers traders a wide range of far more than 1000 tradable financial instruments within 7 asset classes. These include 57 currency pairs, over 1200 international equities from 18 countries, 18 equity indices, 8 agricultural commodities, the precious metals gold and silver, 5 energy commodities (gas & oil) and 5 different crypto currencies in USD pairs. A comprehensive overview of all asset classes and instruments is available on the XM website with all information regarding trading conditions for the individual instruments.

XM Trading Platforms

For the trading platforms, XM relies entirely on MetaQuotes and the MetaTrader 4 and MetaTrader 5 platforms. Both platforms are available for PC, Mac, as WebTrader and in the mobile versions for iPhone, iPad as well as for smartphones and tablets with Android operating system. While both platforms offer all standard features, the MT4 platform can trade currency pairs, stock indices, precious metals and energies, the MT5 platform also offers the possibility to trade more than 1,000 CFDs on stocks and crypto currencies.

XM Trading Accounts Overview

Those who visit the XM website with the overview of trading accounts will notice that they first see a comparison of different properties of the accounts of the branches in the UK, Cyprus and Australia. These are essentially the same, except for the maximum leverage, which is 1:30 for accounts held in the UK and Cyprus, and 1:500 for accounts held in Australia. All three companies in the company offer the same three different account types to traders. In addition to the accounts listed below, the offered free XM demo account with a virtual balance of $100,000 is recommended for beginners. Traders who open their first account with XM Australia will get a $25 No Deposit Bonus.

| Property | Micro Account | Standard Account | XM Zero Account (EU) | Ultra Low Account (AU) |

| Base Currency | EUR, USD, GBP, CHF, AUD, HUF, PLN | EUR, USD, GBP, CHF, AUD, HUF, PLN | EUR, USD | EUR, USD, GBP, CHF, AUD, HUF, PLN |

| Contract Size | 1 Lot = 1,000 | 1 Lot = 100,000 | 1Lot=100,000 | 1 Lot = Standard 100,000, Micro 1,000 |

| Max. Leverage | UK, Cyprus = 1:30, AU = 1:500 | UK, Cyprus = 1:30, AU = 1:500 | UK, Cyprus = 1:30 | AU = 1:500 |

| Spread | from 1 Pip | from 1 Pip | from 0 Pip | from 0,6 Pip |

| Commission | No | No | Yes | No |

| Max. open/pending Orders | 200 | 200 | 200 | 200 |

| Min. Trade Volume | 0.1 Lot | 0.01 Lot | 0.01 Lot | Standard = 0.01 Lot, Micro = 0.1 Lot |

| Max. Lot / Ticket | 100 Lot | 50 Lot | 50 Lot | Standard = 50 Lot, Micro = 100 Lot |

| Islamic Account | Optional | Optional | Optional | Optional |

XM Education and Support for Traders

At XM, especially newcomers to financial trading will find comprehensive support for a successful start. The learning area on the XM website contains more than 40 learning videos, which deal e.g. with setting up a trading account and the correct use of the trading platform. In addition, there are numerous webinars dealing with a wide range of topics. From market discussions and trading opportunities to market technology and trading strategies.

For active trading, traders will find an economic calendar on the XM website that is indispensable for fundamental analysis, with which traders can obtain all important figures in real time. All holders of a real money account also have free access to trading signals on 10 financial instruments at XM. The signals are delivered twice a day and include entry, take profit and stop loss levels. To plan their trades, traders can find various calculators on the XM website, such as a margin calculator or a swap calculator.

XM Deposits and Withdrawals

XM offers a wide range of deposit and withdrawal methods, including Credit Card, NETELLER, Moneybookers Skrill, Bank Transfer, Giropay, WebMoney, Instant Banking, iDEAL and PaysafeCard (for Euro accounts). Please note that Paysafecard, SOFORT Banking, Giropay and iDEAL are not available for withdrawals.

The minimum deposit is $5 for Micro and Standard accounts, $100 for Zero accounts and $50 for AU Ultra Low accounts. Withdrawals are usually processed quickly, so even bank transfers usually only take up the working time of the banks.

Screenshot Website XM Australia

Screenshot Website XM Australia

Final Rating XM Forex and CFD Broker

XM and its parent company, Trading Point of Financials Instrument UK Ltd, offer a wide range of tradeable instruments and trading accounts to meet the needs of most traders. With the MT4 and MT5 trading platforms, traders have all the necessary tools at their fingertips for sufficiently prepared and successful trading. The trading signals published twice a day and the wide range of online webinars are particularly noteworthy. These, together with the micro account offered and the low minimum deposit, provide beginners with the best conditions for a successful start in financial trading.