When trading binary options, it is one of the most profitable ways to follow an existing trend. As long as this continues, it can be traded profitably with high probability. However, also a possible trend reversal or a correction move can be determined within a binary options trading strategy with a relative probability. To this end, the Fibonacci Retracements are used, which are already included in the MetaTrader 4 platform and can be drawn into the chart.

The Fibonacci Retracements are based on a series of numbers that was discovered in the 12th century by the Italian mathematician Leonardo da Pisa. In the MT4 retracements, these are the levels 0.0, 23.6, 38.2, 50.0, 61.8 and 100.0. For this strategy, in addition, the point at 76.4 is required, which must be inserted manually. How this is done can be seen at the bottom of the Fibonacci strategy for forex trading. Each of these plotted levels is an information for the Trader about the possible further price movement. For a better interpretation of this information, the Stochastic is additionally used.

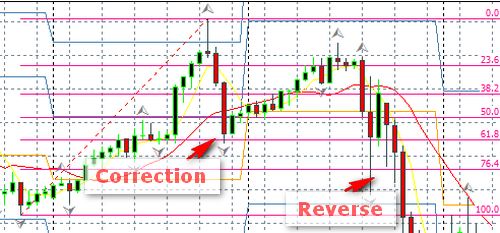

Example of a correction and trend reversal

- When the price reaches the level at 23.6 no action is required usually. This could be a short-term or just beginning correction movement.

- At 38.2, it may already lead to a reversal back to the trend in certain conditions, if the current trend for example, is particularly stable due to released fundamental data.

- When the level at 50.0 is reached, the probability of a reversal has increased significantly. However, here applies special attention to the Stochastic indicator. As long as this does not signal an overbought or oversold market, the correction movement will continue with a high probability.

- If the price reaches the level at 61.8, the trend has clearly lost strength and a trend reversal could be initiated. Indicates the Stochastic however an overbought or oversold market, this probably offer opportunities to buy binary options with short expiring times. Turns the price here significantly in the original direction of the trend, longer expiring times are the better choice.

- At the manually inserted 76.4-level it will be decided whether the direction of the trend has turned or the price will turn back to the original trend. The market here is often indecisive, and the further development should be awaited before a binary option is purchased. If the point is clearly broken towards the 100.0 level, the trend has turned with high probability and could be traded. If it returns above or below the level at 61.8 (long or short), the original trend could regain strength. But before he does not break through the point at 50.0 again, should possibly Binary Options with short expiration time be acquired.

As with all other strategies that are based on a chart in MetaTrader 4,also in the Fibonacci binary options strategy the expiration times should be aligned on the times reflected by the candles on the chart.